How Spreads Work

Posted : admin On 4/9/2022Spread betting is popular amongst traders, however, it’s common for traders to actually lose money when trading spread bets…

This is often due to the fact that traders don’t have a deep understanding of what spread betting is, how it works, how they can take advantage of the benefits and which is the best spread betting broker for them.

In the above example, the spread syntax does not work as one might expect: it spreads an array of arguments into the object literal, due to the rest parameter. Only for iterables Objects themselves are not iterable, but they become iterable when used in an Array, or with iterating functions such as map, reduce, and assign. Measures of Spread Introduction. A measure of spread, sometimes also called a measure of dispersion, is used to describe the variability in a sample or population. It is usually used in conjunction with a measure of central tendency, such as the mean or median, to provide an overall description of a set of data.

- How does Spreadshop work? We are happy to explain! Sell merch, make money, we’ll do everything else. Open a free online shop today!

- Option spreads can be confusion, as one leg is usually a winner when the other is a loser, and vice versa. Mike explains why this is, and why it's important.

- The bid-ask spread is therefore a signal of the levels where buyers will buy and sellers will sell. A tight bid-ask spread can indicate an actively traded security with good liquidity.

Most traders don’t understand leverage and this is crucial when learning to trade with spread bets.

This article is a comprehensive ‘spread betting explained’ guide which will cover all of the important aspects of financial spread betting.

Understanding spread betting and how to spread bet can give you the edge in your trading efforts as well as provide tax-free benefits.

First, let me explain exactly what spread betting is and how it works.

What is spread betting?

Spread betting is a tax-free financial derivative that allows traders to take a position on a security. This can be in the form of stocks and shares, as well indices, commodities, and even bonds.

The big difference between buying stocks and spread betting stocks is that when spread betting we don’t own the underlying asset. Spread betting works by placing a ‘bet’ on the spread – the difference between the buy and sell price.

Spread betting is a popular way of trading because it also enables traders to position themselves long and short on securities. Trading long and short are fancy financial terms of saying we are positioned to profit if the security’s price rises (going long), and if we are speculating that the security’s price would fall then we would be positioned short.

In the below image taken from IG Index, we can see a chart that offers dealing capabilities. Spread bettors can use charts to make strategic decisions and place orders.

Spread betting allows greater versatility for traders because we are able to speculate on prices moving up and down, whereas when buying shares we can only bet that the price will rise.

Spread betting is not to be confused with trading CFDs. Read my article on spread betting vs CFD for more information.

How does spread betting work?

Spread betting is a financial derivative product which traders do not take ownership of the underlying asset that they are betting on. Spread bettors are speculating on the rise and fall of the asset prices they are trading (e.g. stocks), which uses the spread offered by the spread bet broker or trading platform.

Spread betting mimics the underlying asset and reflects the security that the spread bet is mirroring. For example, if we were to buy a spread bet contract on Vodafone, then the price of the spread bet will rise and fall in line with Vodafone’s share price.

As spread betting is technically a bet, it is tax-free so all profits from spread betting are ours to keep. However, many traders lose when trading spread bets, and this article aims to help you become one of the few winning traders of spread bets.

Spread bets have three components:

- First of all, there is the spread, which is the difference between the buy and sell price, and to open a spread bet position we must first pay the spread.

- The second component is the bet size which is the amount of exposure we wish and the amount of money required to fund the position.

- Finally, the last component of spread betting is how long we decide to keep the position open for.

Let’s go over these three concepts in more detail.

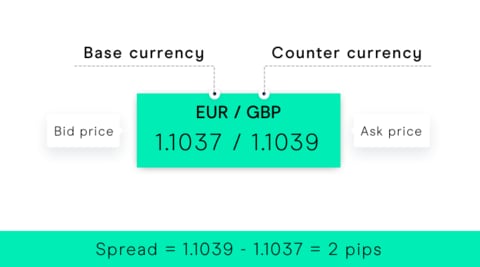

What is the spread in spread betting?

The spread is the difference between the buy and sell prices, and we must pay the spread in order to open a position. For example, if we wished to buy a spread bet contract on Vodafone and the spread was 170p to buy and 169p to sell, then we would pay 1p for every contract we bought (and the same if we were to take a short position too).

The wider the spread on a security, the more we must pay to open our position, and so when trading spread bets it pays to be aware of the percentage of the spread in the security.

What is the bet size in spread betting?

The bet size is the amount that we wish to ‘bet’ or the amount of exposure we wish to take on a spread bet contract. It’s the amount we are betting per point of movement in the underlying security. By choosing our bet size we are choosing our exposure.

Spread betting movements are measured in points and these points can represent pounds, pennies, or even less than a penny. By clicking on the dealing ticket you can find what unit the points are measured in.

For example, if we placed £10 per point on Vodafone shares at 190p to buy, and the unit of point for Vodafone stock was 1 penny, then if the share price moved to 210p to sell and we closed the spread bet we would bank 20 points and £200 would be our profit.

What is the bet duration in spread betting?

The bet duration in spread betting is the length of time before the contract or our position expires. Every spread bet has a fixed timescale, and these can be from either a day or several months in advance.

Generally, spread bets will be offered towards the nearest end of the calendar year’s quarter, and the subsequent quarters afterwards. You can close your spread bet positions whenever you wish (provided the spread bet is open for trading).

The two spread bet durations are daily funded bets and quarterly bets.

- Daily funded bets offer the narrowest spread and interest is paid on the position daily. Therefore, daily funded bets are better for intraday moves or for shorter-term positions

- Quarterly bets expire at the end of the current quarter (or the quarter you choose) and are a futures contract that has the funding costs built into the spread. This means that the spread is wider on this type of contract as no daily interest is paid. However, if you close your quarterly bet after a few days – you won’t receive any of the interest back that you’ve paid in advance. Quarterly bets are best for longer-term positions

In the below image we can see the daily funded bet (DFB), and the quarterly bets ending in September and December 2020, and March 2021. Notice that the spreads get wider as the timeframe becomes longer.

How Spreads Work Betting

Financial spread betting example

Let’s imagine we want to take a long position in Marks & Spencer. We want to have £11,000 of exposure, and the current share price is 110p to buy.

We would need to check the points unit, and with shares the unit is always 1 penny. As the dealing ticket is £1 per point, we would take £11,000 and divide it by the share price of £1.1.

This gives us 10,000, but because each unit of movement is 1 penny we need to divide by another 100. This gives us 100.

Therefore, if we buy £100 per point at 110p, we would have £11,000 of exposure.

£100 x 110 = 11,000. We then take our amount per movement, 10,000 (the pounds need converting into pennies), and multiply this by the share price in pounds. 10,000 x £1.1 = £11,000. Here is a dealing ticket from IG Index showing this in action below.

Notice how the margin required is 20% of the position. Everyone who joins a spread bet provider benefits from negative account protection, meaning that you can’t lose more than you deposit. This is new regulation introduced in 2018 from the European Securities and Markets Authority, and it also stipulated that retail clients can’t be offered lower than 20% margin.

Always remember that 1 penny is equal to 1 share. So if you are betting £20 per point, then that is 2,000 shares. If the share price is £2 then you would have £4,000 of exposure, but if the share price was £20 you would have £40,000 of exposure.

This is why it is important to calculate your total exposure before placing the spread bet.

Enter your email to receive my free UK stock trading handbook, packed with professional techniques to manage risk and consistently profit.

Why should you spread bet?

Spread betting is popular with traders for a variety of reasons.

The main reasons include:

- Spread betting is tax free

- Enables traders to go both long and short

- Offers traders access to leverage

- Provides a wide range of markets to trade

Spread betting is exempt from Capital Gains Tax

When we buy and sell shares outside of an ISA account then we currently have to pay Capital Gains Tax on profits over £12,500.

But by trading in a spread bet account any profits we can keep for ourselves, as spread betting is not subject to Capital Gains Tax.

This is because spread betting is classed as gambling by the UK government, and because spread bets mirror an underlying asset we also don’t need to pay Stamp Duty either.

Tax-free profits and no stamp duty are two big reasons why traders should consider spread betting.

Spread betting enables traders to go both long and short

This is another big advantage of spread betting. When buying and selling shares, we only have the option to buy them and profit from them when the price rises.

However, with spread betting, we can also position ourselves to go short and profit from falling prices. That means if you find a company that you believe is in trouble or may even go bust, you can take a spread bet short position on the stock and profit from the price going down.

With spread betting we can also go long and short on indices, commodities, forex, and many other securities. Here is a chart of Marks & Spencer from SharePad, showing the stock from November 2019 through to July 2020. Anyone who shorted the stock through a spread bet in February could’ve caught a 50% move as the stock fell 50% in just a few weeks.

This is how spread betting can be used to benefit from a stock market collapse.

Spread betting offers traders access to leverage

Another advantage of spread betting is that it allows traders to make their capital go further. Leverage is basically a magnifier, and means we can open positions larger than the capital we have in our spread bet account.

When we open a spread bet position, we will only be required to put down a certain amount of capital to fund the whole position. This is called the margin.

For example, if we want to buy £20,000 of Vodafone stock, and the margin is 20%, then we would only need to put down £4,000 in margin in order to open the position.

However, whilst leverage can magnify profits, it also works both ways and so the risk of loss is also magnified. We should approach trading with leverage carefully and never trade with position sizes that we can’t afford to lose.

Spread betting provides a wide range of markets to trade

As well as stocks and shares, spread betting offers the versatility to trade other financial markets too. We can place positions on indices, as well as speculate on the prices of commodities, and trade foreign exchange, bonds, cryptocurrencies, and other securities.

One advantage of spread betting is that we can hedge positions and portfolios. Investors who believe the market may dip in the short term could open a spread bet short on an index in order to protect their portfolios in a falling market.

Traders who believe the price of gold will rise and would rather trade the underlying asset rather than gold producing stocks can buy and sell gold on spread bets.

How much do I need to start spread betting?

Spread betting, like all trading, carries risk of loss. This is further exacerbated by the leverage factor. Most traders lose when trading spread bets because they take too large position sizes or have no strategy.

Knowing how much one needs to trade spread bets is dependent on the financial market one intends to trade. For example, betting £1 per point on the FTSE 100 would give exposure to the price of the FTSE 100. If the index was at 6,589, then buying £1 per point would give us £6,589 of exposure.

Most shares carry margins of 20%, and so whilst one doesn’t need the full amount of the position size in order to trade, we should never trade with money we can’t afford to lose.

I believe one should have at least £4,000 in trading capital to start with, although this is only my opinion and I am not a regulated financial adviser.

As spread betting is commission-free we only need to consider the spread itself, and overnight funding costs when trading daily funded bets.

How you can get started with spread betting

Spread betting can be a powerful weapon in the trading arsenal if it is utilised correctly and with care.

I use IG Index as my spread betting provider as it offers a wide range of markets and more importantly lots of stocks.

How Spreads Work Forex

How Does The Spread Work

IG Index is a global market leader in spread betting and unlike other spread betting firms does not profit from its clients losses. This is important because IG Index is not incentivised to see its clients lose money. Rather, the company would prefer all traders to profit as profitable traders grow their accounts and pay higher fees in interest. IG index is also listed on the London Stock Exchange and so there is greater transparency over its accounts.

Before starting spread betting, I’d recommend reading my trading handbook (put your email address in the box below and I’ll send it to you). This contains helpful tips of position sizing and risk management, and will increase your chances of success and trading profitably.

I trade spread bets using technical analysis, and I use SharePad in order to find trades and for charting.

How Spreads Work In Football

Spread betting and CFD trading are advanced instruments that come with a high risk of loss due to leverage. 76% of retail investor accounts lose money when trading spread bets and CFD with IG Index. You should decide whether this is a risk you want to take when trading spread bets and trading CFDs, and you should never trade with capital you cannot afford to lose. This article includes an affiliate link and so the website may receive compensation from IG Index.